How to Leave a Legacy For Your TSP Beneficiaries

Here’s to hoping you live for a long, long time in retirement and you get the chance to enjoy the wealth in your Thrift Savings Plan (TSP) account. But we don’t always know when it’s our time to go—and incomplete planning can put the burden squarely on your loved ones.

Here are three ways to leave a legacy of leadership for your TSP beneficiaries.

No. 1: Tell Your Beneficiaries They Are Named, What You Have, and What to Expect

No fair casually dropping this in conversation, either. “Please pass the mashed potatoes. Oh, and by the way, you’re a beneficiary on my TSP account.” Don’t do that! Instead, let them know that you have something important to talk with them about and set aside time for them to take notes, ask questions, and process the information.

Give your beneficiaries a rundown:

- Provide them with your TSP account number and TSP’s phone number (Thrift Savings Plan can be reached via telephone at 1-877-968-3778)

- Let them know that they can call TSP directly for information, resources, and guidance on the process after your death by identifying themselves as a potential beneficiary.

- If you are participating in the TSP Roth, make sure your beneficiaries know that all death benefit payments will be disbursed proportionally from any traditional (non-Roth) and Roth balances in your account. In plain English, they cannot choose whether the payments come from Traditional TSP or Roth TSP. Similarly, if you are a uniformed services employee with tax exempt contributions in your Traditional balance, death benefit payments will contain a proportional amount of tax-exempt contributions as well.

CLICK HERE to get the Free companion guide, The TSP Beneficiary Checklist.

If you are still working when you pass away:

If you (the TSP participant) were still actively employed in Federal service, your personnel or payroll office must report the death to TSP before TSP can begin processing death benefits from the account.

If you are done working when you pass away:

If you (the TSP participant) die in retirement/after separating from service, a next of kin, legal representative, or other responsible person must report your death to TSP.

Whether or not you were working at the time of your death, your survivor(s) will be considered “Potential Beneficiaries” until they are vetted by TSP’s processes. They must completely fill out and submit a TSP-17 Information Relating to Deceased Participant Form, along with a copy of your certified death certificate citing the final cause of death.

No. 2: Encourage Your Beneficiaries to Seek Tax Advice

Your beneficiaries may or may not understand what inheriting a retirement account means. Many people have trouble wrestling with complex retirement concepts and tax planning during normal times. Keep in mind that these tax decisions are being thrust on them while they are grieving your death.

There’s no shame in seeking professional advice—in fact, it can potentially save your beneficiaries from adding insult (costly mistakes) to injury (losing you). Many of these decisions are irrevocable since funds cannot be returned to TSP once a death benefit payment is made.

For Example

Let’s take a look at TSP’s Required Minimum Distribution (RMD) rules for a Spousal Beneficiary [See Death Benefit Information for Participants and Beneficiaries (TSPBK31)] in their own words:

“The Internal Revenue Code (IRC) requires that you begin receiving annual distributions from your beneficiary participant account according to its required minimum distribution rules. These rules require you to receive a certain portion of your account each year based on your life expectancy. The required minimum distribution rules apply to both Roth and traditional (non-Roth) portions of your account.

The date on which you must begin receiving required minimum distributions (RMDs) depends on whether the deceased participant died before or on/after his or her “required beginning date.” The required beginning date is defined as April 1 of the year following the year a participant reaches age 72, or separates from government service, whichever is later.

If your spouse died before his or her required beginning date, you, as the beneficiary, must begin receiving annual RMDs by either December 31 of the year the deceased participant would have turned 72 or December 31 of the year following the year the participant died, whichever is later. You must continue to receive distributions by December 31 of each subsequent year. We will base all of your RMDs on your age, not your spouse’s.

If your spouse died on or after his or her required beginning date, you, as the beneficiary, must begin receiving required minimum distributions by December 31 of the year of the participant’s death unless the participant had already received that year’s RMD. That first year’s RMD will be calculated based on your spouse’s age. You must continue to receive RMDs based on your age in each of the years that follow.

IMPORTANT NOTE: If your spouse was born before July 1, 1949, substitute age 70 ½ for age 72 in the explanation above.

The RMD rules are complex. You can find more detailed information about them in the TSP tax notice Tax Information About TSP Withdrawals and Required Minimum Distributions for Beneficiary Participants.”

As you can see, even TSP acknowledges that the rules are complex.

CLICK HERE to get the Free companion guide, The TSP Beneficiary Checklist.

We’re not saying this stuff is “un-figure-out-able.” But we are urging you to keep in mind that your loved ones will be in mourning. Pave the pathway for them to get some support, especially when making the tax decisions that come with inheriting funds in a TSP account.

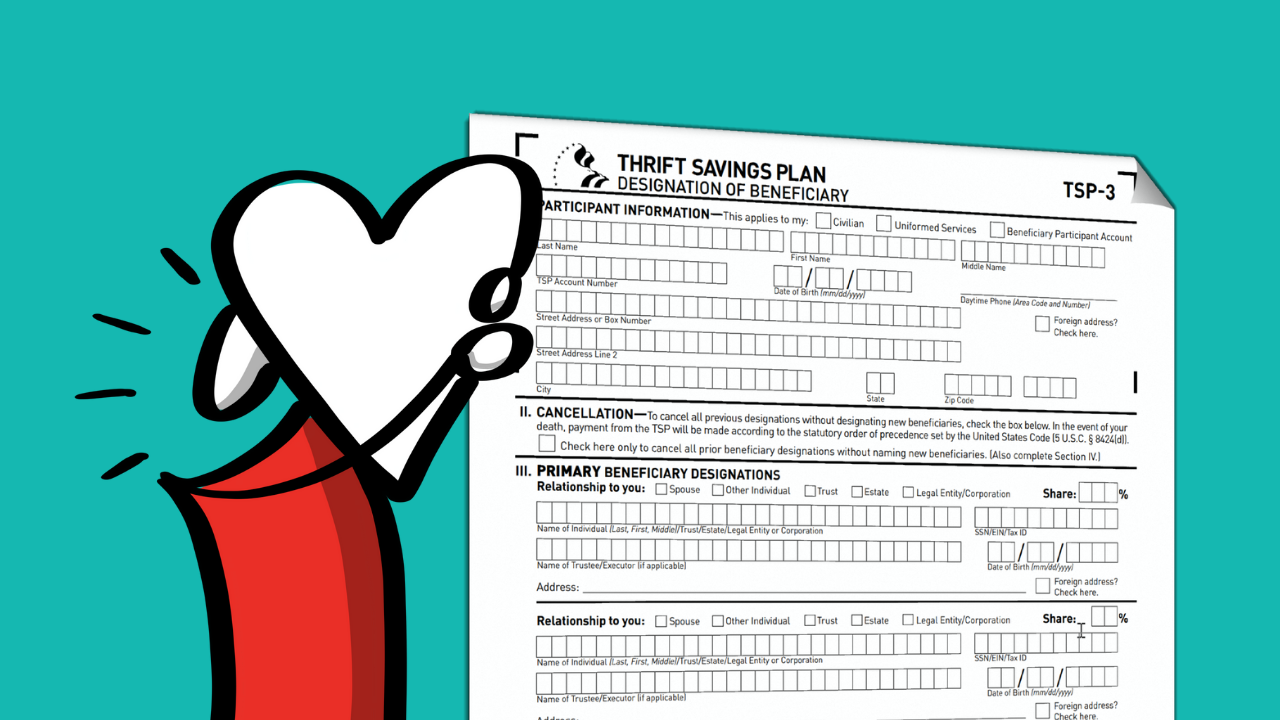

No. 3: Actually Name Them and Keep Your Form Up To Date

It’s paramount to understand that TSP will only honor their established process for paying out death benefits. They will strictly adhere to the most recent beneficiaries on file. Stated another way: you cannot rely on your will, trust, prenuptial agreement, separation agreement, property settlement agreement, or court order to specify who will inherit your TSP account because TSP does not use any of these documents to distribute death benefit payments. See Death Benefit Information for Participants and Beneficiaries (TSPBK31)

Once your death is reported to TSP, they will reach out to your beneficiaries via mail at their last known address. Therefore, it’s also wise to update your beneficiary forms whenever your beneficiaries move, or if they change their name due to marriage/divorce.

What Happens If No Beneficiary Is Listed?

If your Beneficiary Designation reads “None,” on your TSP Statement, that means you’re relying on Order of Precedence. When there are no named beneficiaries on file or all named beneficiaries are deceased, TSP will fall back on this pre-determined order in which to pay your remaining family members. See Death Benefit Information for Participants and Beneficiaries (TSPBK31)

We’ll define this for you below, but before we do, know this: using Order of Precedence puts the burden of proof on your beneficiaries to complete all documentation to show that they are, in fact, entitled to the money. They also must wait for TSP to complete a much longer and more involved payout process.

Order of Precedence goes as follows:

- To your spouse.

- If none, to your child or children equally, with the share due to any deceased child divided equally among that child’s descendants. (As used here, “child” means either a biological child or a child adopted by the participant. It does not include your stepchild unless you have adopted the child. Nor does it include your biological child if that child has been adopted by someone other than your spouse.)

- If none, to your parents equally or to your surviving parent. (Parents does not include stepparents who have not adopted you.)

- If none, to the appointed executor or administrator of your estate.

- If none, to your next of kin who is entitled to your estate under the laws of the state in which you resided at the time of your death.

Final Thoughts

If you wait to address your beneficiaries head-on, you might not get the chance to be the leader you had envisioned. Make sure that your TSP-3 Designation of Beneficiary is current and up-do-date.

CLICK HERE to get the Free companion guide, The TSP Beneficiary Checklist.

© 2020 The Monroe Team, Inc.

FERS Blueprinttm is an educational division of The Monroe Team, Inc. DUNS Number: 032 057260. CAGE Code: 735L3. NAICS Code: 611710 Educational Support Services. Woman-owned, small business.

FERS Blueprinttm is not affiliated with, endorsed or sponsored by the Federal Government or any US Government agency. FERS Blueprinttm is educational only. No specific financial, retirement nor tax advice is being offered. The material presented is as current as possible, but is necessarily generalized. Facts and opinions are based on research and experience, but are not endorsed by the Federal Government. It is recommended to consult with your personnel office and/or the Office of Personnel Management (OPM) Retirement Office, Thrift Savings Plan, Social Security, Medicare, Internal Revenue Service, your legal, tax and/or other advisor(s).